In today’s digital world, keeping track of credit card expenses is key. This is important for both personal and business finances. Turning your credit card statement into Excel lets you track budgets, analyze spending, and get ready for taxes. This way, you can do detailed financial analysis that fits your needs. This guide shows you how to convert credit card statements to Excel. It includes step-by-step instructions, examples, benefits, and answers to common questions.

What is a Credit Card Statement?

A credit card statement is a monthly summary from your credit card provider. It shows all transactions, payments, and charges for the billing cycle. It includes:

- Transaction history (purchases, refunds, fees)

- Statement period and due date

- Minimum payment due

- Total outstanding balance

- Interest charges, if applicable

- Rewards summary (if any)

Statements are typically available in PDF, CSV, or online formats. PDFs are common, but they’re not easy to edit. So, converting to Excel is important for analysis and tracking.

How to Convert Credit Card Statement to Excel?

The method you use depends on how your statement is delivered (PDF or CSV). Below are the most efficient ways to convert:

Method 1: Download Statement as CSV or Excel Format (If Available)

Some credit card issuers let users download statements as CSV or XLSX files.

Steps:

- Log into your credit card online portal

- Navigate to Statements or Transaction History

- Select your desired date range

- Click Download and choose CSV/XLSX

- Open the file using Excel or Google Sheets

Note: CSV files may need some formatting (column headers, date standardization) once opened.

Method 2: Convert PDF Credit Card Statements to Excel

Most banks issue PDF credit card statements, which aren’t directly editable. Use tools to convert.

Steps:

- Upload the PDF to your preferred converter

- Select Excel (.xlsx) as the output format

- Download the converted file

- Open in Excel and clean up merged rows/columns if necessary

Tip: For scanned PDFs, use tools with OCR (Optical Character Recognition) functionality.

Method 3: Manual Copy-Paste for Simple PDFs

If the statement is not encrypted and data is presented clearly in tables:

- Open the PDF alongside Excel

- Manually copy the transaction tables

- Paste into Excel and clean the formatting (e.g., columns, borders, headers)

Best for basic, text-based PDF statements.

Example 1: Using CSV Download

- You download a CSV file from your bank portal

- Open in Excel and add filters to sort by:

- Transaction type

- Merchant

- Amount

- Use Excel formulas to calculate total spending per category

Example 2: Using OCR on a Scanned PDF

- Upload scanned PDF to Adobe Acrobat with OCR enabled

- Convert to Excel

- Use Excel to identify:

- Duplicate charges

- Monthly interest calculation

- Expense trends via pivot tables

Benefits of Converting Credit Card Statements to Excel

Streamlined Budgeting

Excel helps you track your spending in areas like groceries, travel, dining, and subscriptions. Create a dynamic monthly budget using SUMIF formulas and custom filters based on actual usage.

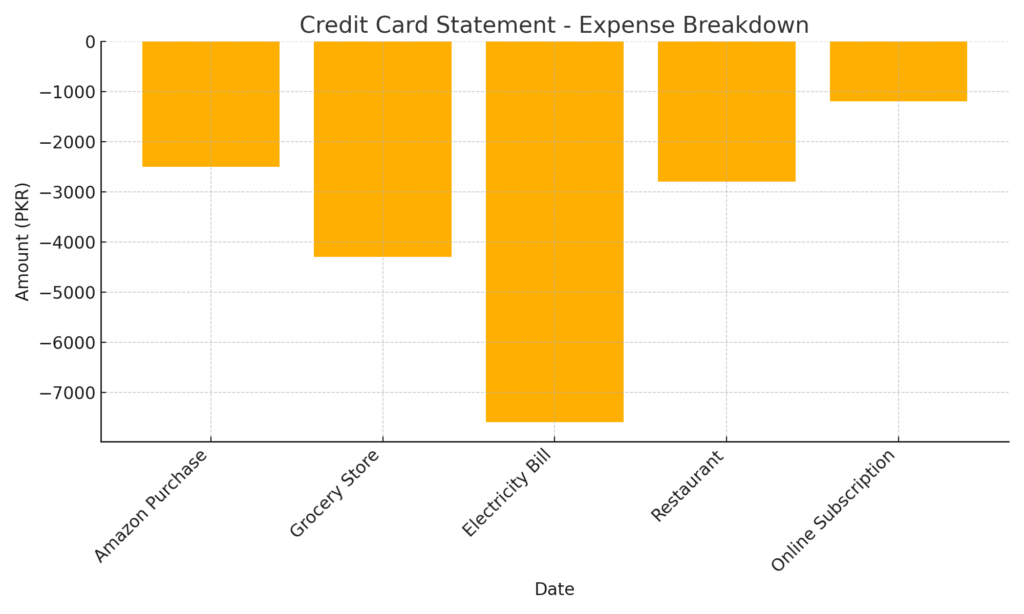

Custom Reporting & Visualization

Credit card data in Excel can be transformed into dashboards and visual charts. You can:

- Build pie charts of spending distribution

- Create line graphs to show monthly trends

- Highlight spikes or unusual purchases

Error & Fraud Detection

Manual reviews of PDF statements are time-consuming. In Excel, filters and conditional formatting can highlight:

- Double charges

- Suspicious activity

- Fees and penalties

This allows for quick dispute resolution with your bank.

Improved Tax Preparation

You can categorize credit card transactions for business expenses, travel, or subscriptions. Then, you can export them into your accounting tools. During tax season, this reduces the burden of collecting deductible transactions.

Integration with Accounting Tools

Tools support data uploads from Excel. It makes reconciliations easier and keeps financial records accurate for business owners and freelancers.

Data Backup and Portability

You can easily store Excel files in cloud services like Google Drive or OneDrive, or you can back them up locally. This ensures you can access and move your financial records long-term, even if your online bank access changes.

3 Quick methods to import Credit Card PDF Statement into Excel

FAQ’s

Can I convert credit card statements from mobile apps?

Yes, most banking apps allow you to email or download the PDF version of your statement. You can then use an online converter or transfer it to your computer for conversion to Excel.

Are free PDF to Excel converters safe?

Choose trusted providers that have privacy policies. Make sure they delete your files after conversion. For sensitive documents, use offline software like Adobe Acrobat or Able2Extract.

Why do some PDF conversions look messy in Excel?

Complex formatting or merged cells in PDFs may not translate cleanly. After conversion, you may need to:

- Adjust headers

- Split columns

- Remove blank rows

Can I automate this process monthly?

Yes. Use Power Automate (Windows) or Zapier to set up workflows that:

- Download your statement

- Convert it to Excel

- Send to Google Drive or email

Is it legal to convert bank or credit card statements?

Yes, as long as you’re accessing your own data for personal or business use. Avoid modifying the data for third-party purposes or fraud.

Conclusion

Converting your credit card statement to Excel unlocks a wealth of financial insights. Excel is great for managing your spending data. It helps with budgeting, fraud detection, tax preparation, and business accounting. Using direct CSV downloads, PDF converters, or manual methods can help you get your credit card data into Excel. This makes it easier to make better decisions.