Organizing your finances is easier when your data is in an editable format. A great way to analyze your finances is by converting your bank statement to Excel. Excel helps with tracking business expenses, making tax documents, and creating personal budgets. It provides the tools you need for detailed analysis. This guide shows you how to convert your bank statement to Excel. You’ll find detailed steps, examples, benefits, and FAQs.

What is a Bank Statement?

A bank statement is an official record from a bank. It summarizes all transactions in your account for a specific time, usually monthly. It includes:

- Deposits and withdrawals

- Card payments and transfers

- Bank fees and interest

- Opening and closing balances

Statements can be in PDF, paper, or digital formats. They are important for accounting, auditing, tax filing, and budgeting.

How to Convert Bank Statement to Excel

Converting a bank statement to Excel involves a few straightforward steps. The method may change based on the statement format, like PDF, CSV, or online access. Here are the best options:

Method 1: Download as CSV from Online Banking

Most banks offer a download CSV option within their online banking dashboard. Here’s how:

- Log into your online banking portal

- Go to Account Statements or Transaction History

- Choose the desired date range

- Click Download or Export, and select CSV format

- Open the file in Microsoft Excel or Google Sheets

Pro Tip: If your bank only provides PDF statements, skip to the next method.

Method 2: Convert PDF Bank Statements to Excel Using OCR Tools

Use OCR (Optical Character Recognition) software or a PDF-to-Excel converter if you only have a PDF bank statement.

Steps:

- Open the PDF bank statement in your chosen tool

- Select “Convert to Excel” or similar option

- Download and open the resulting .xlsx or .csv file

- Format the data for consistency (headers, date format, etc.)

Note: For scanned PDFs, ensure the OCR feature is enabled to extract data from images.

Method 3: Manual Copy-Paste for Simple Statements

If the PDF isn’t locked and has a clean layout:

- Open the PDF and Excel side by side

- Manually copy data columns and paste into Excel

- Clean up any formatting or spacing issues

This method works best for simple, non-scanned bank statements.

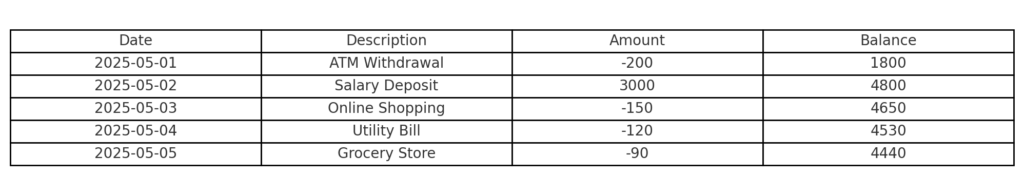

Example: Converting a Bank Statement

Scenario:

You received a monthly bank statement in PDF format and want to analyze your spending habits.

Steps:

- Upload and convert the PDF

- Download the Excel file

- Open in Excel and apply filters to:

- Sort by date

- Categorize transactions (e.g., food, rent, utilities)

- Create pivot tables for summary analysis

By visualizing your spending patterns, you can identify areas for budget optimization.

Benefits of Converting Bank Statements to Excel

Custom Analysis and Filtering

Excel enables advanced filtering, sorting, and searching features. You can check specific transactions, mark suspicious activity, or sort expenses as needed.

Budgeting and Financial Planning

In Excel, you can use your data with budgeting templates. You can also integrate it with personal finance tools. You can calculate monthly budgets, forecast expenses, or plan savings more efficiently.

Audit-Readiness

Businesses and freelancers need accurate records. Excel statements help create financial reports, track invoice payments, and meet audit needs.

Integration with Accounting Software

Tools like QuickBooks, Xero, or Zoho Books allow Excel uploads for expense management and reconciliation, making the bookkeeping process seamless.

Data Visualization

Use Excel to create graphs and dashboards from your transaction history. This helps in identifying trends like recurring expenses or seasonal spending peaks.

Tax Preparation

During tax season, having transaction data in Excel format simplifies reporting. You can separate deductible expenses, add up totals, and create documents for tax filing.

Error Detection

Converting to Excel helps you easily find double charges, bank mistakes, or unauthorized transactions. These issues can be tougher to spot in static PDFs.

Importing Bank Statement PDF into Excel via Power Query

FAQ’s

Can I convert a scanned bank statement to Excel?

Yes, but you’ll need an OCR-based tool like Adobe Acrobat or PDFTables to extract data from the scanned image.

Is converting a bank statement to Excel secure?

As long as you use reputable software and store the files securely, it is safe. Don’t use free online converters for sensitive documents. Only use them if they have encryption and data deletion policies.

Why does the Excel file look disorganized after conversion?

That’s common if the PDF layout is complex. You may need to reformat columns, remove merged cells, and align headers manually.

Can I automate the process?

You can automate regular imports from CSV to Excel or Google Sheets. Tools like Power Automate, Zapier, and Google Apps Script can help with this.

Conclusion

Turning your bank statement into Excel is an easy and effective way to manage your money. Excel helps users make smart choices. It organizes data for budgeting, tax filing, and financial forecasting. If you’re a business owner, freelancer, or want clearer finances, this guide helps you. It gives you reliable and secure ways to achieve that conversion.

Good post. I learn something new and challenging on websites I stumbleupon everyday.

It’s always useful to read articles from other authors and use

a little something from their sites.